Contact Our Firm

The use of the Internet or this form for communication with the firm or any individual member of the firm does not establish an attorney-client relationship. Confidential or time-sensitive information should not be sent through this form.

I have read and understand the Disclaimer and Privacy Policy.

Recent Blog Posts

New Federal Employment Laws Every Business Owner Should Be Aware Of

When you own a business, there are many issues that you need to stay on top of in order to avoid any financial or legal problems. One of those critical areas is employment law. Not only are there state laws you need to abide by, but there is also a long list of federal laws and regulations your company needs to be adhering to. This means you also need to be aware of any changes the government makes to these laws. The following is a brief overview of some of the federal employment law changes that took place in 2022. For more details, or if you are having any employment law issues, The Elliot Legal Group, P.A. can help.

When you own a business, there are many issues that you need to stay on top of in order to avoid any financial or legal problems. One of those critical areas is employment law. Not only are there state laws you need to abide by, but there is also a long list of federal laws and regulations your company needs to be adhering to. This means you also need to be aware of any changes the government makes to these laws. The following is a brief overview of some of the federal employment law changes that took place in 2022. For more details, or if you are having any employment law issues, The Elliot Legal Group, P.A. can help.

The Ending Forced Arbitration of Sexual Assault and Sexual Harassment Act

In March 2022, the Ending Forced Arbitration of Sexual Assault and Sexual Harassment Act was signed into law. The Act amended the Federal Arbitration Act, giving anyone alleging sexual harassment or sexual assault claims (under federal, state, or tribal law) the option to litigate their claim in court even if they had previously agreed to arbitration. The Act also allows individuals (or a representative) to bring sexual harassment or sexual assault claims through a collective or class action lawsuit even if they had previously waived that right.

Is an Electronic Signature Legally Valid?

The internet has made doing business online almost second nature over doing it in person. This became even more prevalent during the COVID-19 pandemic, with many businesses providing services virtually. Many companies have extended this prevalence beyond the pandemic and still operate a good bulk of their business online.

The internet has made doing business online almost second nature over doing it in person. This became even more prevalent during the COVID-19 pandemic, with many businesses providing services virtually. Many companies have extended this prevalence beyond the pandemic and still operate a good bulk of their business online.

This also includes the signing of business contracts. Many of us have received a contract that requires an electronic signature in order to be valid. But some people question whether these types of documents are actually legally valid and if they would hold up in any kind of contract dispute and/or litigation.

What Does the Law Say?

In 1999, the Uniform Electronic Act was adopted by 47 states. Florida passed its own version of the law in 2000 (SB-1334). This law states that electronic signatures can be considered legally binding and holds the same legal obligations and commitments as a signature that is done manually. While the purpose of the law was to stipulate what the requirements were in order for electronic signatures to be legally valid, it failed to provide clear and concise definitions as to which platforms or technologies should be used when providing an electronic signature.

How Zoning Laws Can Affect Your Florida Business

Every municipality – whether a large, bustling city or a small rural town – has zoning laws or ordinances in place. The municipality is broken up into areas (zones) and each zone has regulations regarding how it can be used. When a business is looking for a location for operations, it is critical for that business to be aware of what the zoning laws are for the properties they are considering. These zoning laws can impact just what is allowed and is not allowed at that location.

Every municipality – whether a large, bustling city or a small rural town – has zoning laws or ordinances in place. The municipality is broken up into areas (zones) and each zone has regulations regarding how it can be used. When a business is looking for a location for operations, it is critical for that business to be aware of what the zoning laws are for the properties they are considering. These zoning laws can impact just what is allowed and is not allowed at that location.

Florida Zoning Laws

Florida has stringent zoning ordinances, which are also referred to as land use regulations, in place. The purpose of these laws is two-fold: regulate the growth of the municipality and protect the community the property is located in. Some of the more common types of zones an area can be broken into include:

-

Residential – For homes

Are You Considering a Merger and Acquisition for Your Florida Business?

As your business grows, one issue that may come up is whether or not merging with or acquiring another business would be financially beneficial. Last year, there were just under 25,000 mergers and acquistions in the United States, alone. If taking this step is something your company is considering, it is critical that you consult with a Fort Lauderdale business attorney who is skilled in this area of law. Having an attorney advocating for you will ensure that your business is protected throughout the process, as well as ensure that all applicable regulations and laws are being adhered to.

As your business grows, one issue that may come up is whether or not merging with or acquiring another business would be financially beneficial. Last year, there were just under 25,000 mergers and acquistions in the United States, alone. If taking this step is something your company is considering, it is critical that you consult with a Fort Lauderdale business attorney who is skilled in this area of law. Having an attorney advocating for you will ensure that your business is protected throughout the process, as well as ensure that all applicable regulations and laws are being adhered to.

What Is a Business Merger and Acquisition (M&A)?

When one business merges with the other, it is a consolidation of the two companies through financial transactions between the two. This can involve:

-

Purchasing and absorbing the other company entirely

Make Sure Your Company Is Complying with Federal and State Laws During the Hiring Process

One of the most critical components to the success of a business is its employees. But hiring employees can be a complicated process. Not only do you need to feel confident you are hiring the right person for the position, but you also need to make sure you are adhering to all federal and state rules and regulations as you navigate through that process. A simple mistake can be costly, resulting in fines and expensive litigation. The following are some of the most common errors companies make in their hiring process and are ones you want to avoid.

One of the most critical components to the success of a business is its employees. But hiring employees can be a complicated process. Not only do you need to feel confident you are hiring the right person for the position, but you also need to make sure you are adhering to all federal and state rules and regulations as you navigate through that process. A simple mistake can be costly, resulting in fines and expensive litigation. The following are some of the most common errors companies make in their hiring process and are ones you want to avoid.

Watch Your Ad Language

Both federal and Florida laws prohibit any type of discriminatory language in job postings. This includes language that mentions:

-

Age

-

Ancestry

-

Disability

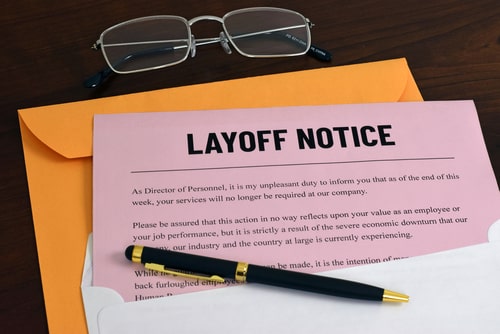

Understanding the Requirements of the WARN Act

Over the past couple of months, Elon Musk’s purchase of Twitter has dominated the news from the very day he walked into the corporate offices. During the first couple of weeks, there were reports of massive layoffs throughout multiple divisions of the company. It was estimated that within the first couple of weeks, more than half of the social media company’s workforce has been laid off.

Over the past couple of months, Elon Musk’s purchase of Twitter has dominated the news from the very day he walked into the corporate offices. During the first couple of weeks, there were reports of massive layoffs throughout multiple divisions of the company. It was estimated that within the first couple of weeks, more than half of the social media company’s workforce has been laid off.

All of these layoffs have also raided the issue of whether or not Musk and Twitter have violated the federal Worker Adjustment and Retraining Notification (WARN) Act, as well as similar state laws. Both employers and employees should be aware of the ramifications of WARN Act violations and the harsh penalties a company could face.

What Is the WARN Act?

Under the WARN Act, a company that employs 100 or more workers is required to provide at least 60 days’ notice before initiating mass layoffs. Mass layoffs are deemed those that affect at least 50 workers for a layoff affecting a minimum of one-third of the company or one that affects at least 500 employees during a one-month period.

Protecting Your Personal Finances from Business Liabilities

While it is exciting to start your own company, the business structure you choose for that company can be critical to your financial future. One of the most popular choices is a limited liability company (LLC). One of the goals of forming an LLC is to prevent any personal liability or financial responsibility for any debts or other issues the company incurs. Although in most cases, an LLC will provide those protections, there may be situations where the owner of the company could face personal liability. A business attorney can explain some steps to take to avoid these types of issues.

While it is exciting to start your own company, the business structure you choose for that company can be critical to your financial future. One of the most popular choices is a limited liability company (LLC). One of the goals of forming an LLC is to prevent any personal liability or financial responsibility for any debts or other issues the company incurs. Although in most cases, an LLC will provide those protections, there may be situations where the owner of the company could face personal liability. A business attorney can explain some steps to take to avoid these types of issues.

Keeping Personal and Business Finances Separate

It is critical to keep your finances separate. Commingling business and personal assets can result in the owner facing personal liability for business debts, even though the business is an LLC. Mixing funds could give the legal impression that the business is not really a separate entity. There should be a bank account(s) for the business, set up in the legal name of the business, and a separate bank account(s) for personal funds.

How Do Florida Businesses Obtain Trademark Protection?

One of the most important assets that a business has is its trademark. This is why it is so critical to take the necessary legal steps to protect your trademark and ensure your business has exclusive rights to this branding. The best way to protect your trademark is to register it with the U.S. Patent and Trademark Office. A business attorney can assist you with this process.

One of the most important assets that a business has is its trademark. This is why it is so critical to take the necessary legal steps to protect your trademark and ensure your business has exclusive rights to this branding. The best way to protect your trademark is to register it with the U.S. Patent and Trademark Office. A business attorney can assist you with this process.

Levels of Trademark Protection

A business should apply for trademark protection for products, goods, or any other tangible objects that can be sold. There are three levels of trademark protection that a business can apply for.

The first level is referred to as common law protection. This type of protection uses the ™ symbol to the right of the top of the symbol or logo the company is using. The symbol lets the public know what the company’s trademark is and that the company is claiming exclusive rights to the symbol or logo it is attached to. Although using this symbol may protect your symbol or logo within your local area, it will not provide protection state or nationwide.

Should My Business Use Arbitration Clauses in Our Contracts?

One of the most common clauses that are added to business contracts is an arbitration clause. Many businesses prefer arbitration over litigation, especially given the time and money that litigation can cost a company. If you are considering the use of arbitration clauses in your company’s contracts, make sure you contact a Broward County business attorney to learn the advantages and disadvantages of the arbitration process.

One of the most common clauses that are added to business contracts is an arbitration clause. Many businesses prefer arbitration over litigation, especially given the time and money that litigation can cost a company. If you are considering the use of arbitration clauses in your company’s contracts, make sure you contact a Broward County business attorney to learn the advantages and disadvantages of the arbitration process.

What Is Arbitration?

Arbitration is an alternative dispute resolution process where, per agreement of the parties involved in the dispute, a neutral third party or parties makes a decision that is legally binding. The decision is also private since there are no public filings for the process nor are there any public records.

The parties who are involved in the dispute choose the arbitrator or arbitrators who will then become the party that will resolve the dispute. The arbitration process is less formal than a civil court proceeding, and the arbitrators’ decisions are typically rendered faster than decisions by the court. However, the arbitrator’s decision is legally binding and may be filed as an order of the court.

The Legal and Financial Consequences of a Data Security Breach

Almost on a weekly basis, the news is filled with another company that has suffered a data breach. And the financial repercussions of a breach for a business can be devastating. Just last week, T-Mobile announced a $350 million settlement for a 2021 cyberattack that exposed millions of their customers’ personal information. The company has identified approximately 76 million customers who were affected by the breach.

Almost on a weekly basis, the news is filled with another company that has suffered a data breach. And the financial repercussions of a breach for a business can be devastating. Just last week, T-Mobile announced a $350 million settlement for a 2021 cyberattack that exposed millions of their customers’ personal information. The company has identified approximately 76 million customers who were affected by the breach.

Although the company is taking a significant financial hit with the settlement, given the size of the corporation, it is likely its financial standing will not be affected in the long run. Unfortunately, for many smaller businesses, a data security breach and the financial penalties that can result can be disastrous.

Hackers Wreaking Havoc

Under the law, all businesses owe a duty of care to their customers to protect their personal information. When hackers steal that information in a data security breach, it can and does cause many issues for those whose information is stolen. Hackers can apply for credit cards in customers’ names, access their financial accounts, and even apply for government benefits.